Tax Assessor: Kevin Esposito

Tax Assessor: Kevin Esposito

Address: Municipal Building, 182 Market Street, Elmwood Park, NJ 07407

Phone: 201-796-1457 x8804

Fax: 201-796-1694

E-mail: This email address is being protected from spambots. You need JavaScript enabled to view it.

Office Hours: Mon-Thurs, 8:30am-4:30pm and Fridays 8:30am-3:00pm

Mr. Esposito's Hours: Wed 8:30am-12pm; Thurs 3:30-6pm by Appointment ONLY

Tax Appeals

The following information was developed by the Bergen County Board of Taxation to assist taxpayers in properly preparing for tax appeal hearings. It includes general information derived from New Jersey laws which govern tax appeals: Administrative Code Title 18:12 and New Jersey Statutes Titles 54:3 et seq and 54:4 et seq.

The Bergen County Board of Taxation recognizes recent changes in the appeal process have made procedures more complex. This presentation was developed as an aid to the property owner, but it should not be considered as an all inclusive guide. Most importantly, it is essential taxpayers understand they must prove their assessment is unreasonable compared to a market value standard. Your current assessment is by law assumed to be correct. You must overcome this presumption of correctness to result in an assessment change.

What is the basis for my assessment?

In order for an assessment to be deemed excessive or discriminatory, a taxpayer must prove an assessment does not fairly represent one of the two standards:

- Following a revaluation, all assessments must represent 100% of true market value as of the previous October 1. The October 1 pre-tax date is called the annual assessment date. All evidence submitted in a tax appeal must be on or near the assessment date, especially property sales used as comparables.

- The other standard is the common level or common level range established in your municipality. To explain the common level range you must consider what happens following a revaluation. or reassessment. Once a revaluation or reassessment is completed, external factors such as inflation, appreciation, and depreciation may cause values to increase or decrease at varying rates.

Other factors such as physical deterioration may contribute to changes in property values. Obviously, if assessments are not adjusted annually, a deviation from 100% of true market value will occur.

The State Division of Taxation annually conducts a fiscal year sales survey, investigating most property transfers that occur in your community, with your local assessor assisting. Every sale is compared individually to every assessment to determine an average level of assessment in a municipality. An average ratio is developed from a sampling of property sales to represent the assessment level in your community. In any year, except the year a revaluation or reassessment is implemented, the common level of assessment is the average ratio of the district in which your property is situated and is used by the Tax Board to determine the fairness of your assessment. The sales ratios are reviewed inter and intra for each municipality.

How do I know if my assessment is fair?

The New Jersey Legislation adopted a formula known as Chapter 123 in 1973 to test the fairness of an assessment. Once the Tax Board has determined the true market value of a property during an appeal, they are required to automatically compare the true market value to the assessment. If the ratio of the assessment to the true value exceeds the average ratio by 15%, then the assessment is automatically reduced to the common level. However, if the assessment falls within this common level range, no adjustment will be made. If the assessment to true value ratio falls below the common level, the Tax Board is obligated to increase the assessment to the common level. This test assumes the taxpayer will supply sufficient evidence to the Tax Board so they may determine the true market value of the property subject to the appeal. You should inquire into your district's average ratio before filing a tax appeal. This ratio changes annually on October 1, for use in the subsequent tax year.

What is a tax appeal hearing and who will hear my appeal?

Once you have filed your tax appeal, a hearing before the Bergen County Tax Board is scheduled. The Bergen County Board consists of 5 members appointed by the governor. The Tax Board Commissioners are appointed primarily to hear disputes involving assessments. The municipality is the opposing party and will be represented by the municipal attorney. The assessor and/or an appraiser may appear at your hearing as an expert witness for the municipality.

Is a hearing always necessary?

A hearing is always necessary. If the assessor, municipal attorney, and the taxpayer agree to a settlement or the issues are otherwise resolved, it may not be necessary for you to attend your hearing, particularly if a settlement stipulation form is submitted to the Tax Board for their approval.

When are the tax appeal hearings held?

Tax appeal hearings are generally held after the April 1 annual deadline. Adjournments are generally denied. It is suggested that you make every attempt to attend your hearing. If you miss your hearing and have not received a written notice postponing your case, you may assume the case has been dismissed. If you do not attend your hearing, your case will be dismissed for lack of prosecution.

What is good evidence to convince the Tax Board to reconsider an assessment?

You cannot appeal the taxes on your property since the taxes are the result of the local budget process. You must pay the collector all taxes and municipal charges up to and including the first quarter of the tax year. Remember, the burden is on you, the appellant, to prove your assessment is unreasonable, excessive, or discriminatory. It is necessary for you to prove at the onset that your assessment is in error. It is also necessary for you to suggest a more appropriate value.

The taxpayer must be persuasive and present credible evidence. Credible evidence is evidence supported by fact, not assumptions or beliefs. Photographs of both the subject property (the property subject to the appeal) and comparables are useful in illustrating your argument. Factual evidence concerning special circumstances is necessary. For example, if the property cannot be further developed for some reason, evidence must be provided.

The most credible evidence is recent comparable sales of other properties of a similar type in your neighborhood. Remember, if you are going to discuss comparable sales, not less than three comparable sales shall be submitted to the Assessor, Clerk, and County Tax Board, not less than one week prior to the hearing if not included with the petition of appeal. Sales of all properties (SR-1A's) are available for your review at the County Tax Board. Comparable means most of the characteristics of your property and the neighboring sale is similar. You should be knowledgeable of the conditions of the sales you cite including financing and be able to give a full description of the properties. Some of the characteristics making your property comparable are: recent sale price, similar square footage of living area measured from the exterior, similar lot size or acreage, proximity to your property, the same zoning use (e.g. duplex in a duplex zone), and similar age and style of structure, etc.

If the property was recently purchased, how is this purchase considered?

An assessment is an opinion of value. Uniformity of treatment dictates minor adjustments are not made simply due to a recent sales price. For various other reasons the subject's sales price may not necessarily be either conclusive evidence of the property's true market value, or binding upon the Tax Board. An examination of the circumstances surrounding a sale is always important.

Will the appeal be private?

No. All meetings of the Board of Taxation are public meetings.

Are there special rules for commercial properties?

Yes. Owners of rental income properties must supply an income statement at the time of filing on special forms provided by the Tax Board. Since the income generated by a property has a direct bearing on the owner's ability to market the property, and therefore its value, this evidence may be useful in arguing both sides of an appeal.

Who is an expert witness?

Besides your municipal assessor, anyone whose occupation is a real estate appraiser, and whose designation as such is from a legitimate association of professionals, is considered an expert. An expert's qualifications may be challenged by the municipal attorney at the hearing.

In addition, if you intend to rely on expert testimony at your hearing, you must supply one copy of an appraisal report to the assessor, and one copy to every member of the County Tax Board and Tax Administrator at least 7 days in advance of the scheduled hearing. The appraiser who completed the report must be available at the hearing to give testimony and to afford the municipality and Tax Board an opportunity to cross-examine the witness.

May I further appeal the judgment of the Tax Board if I am still dissatisfied?

If you are dissatisfied with the judgment rendered by the Tax Board, you will have 45 days from the date your judgment was mailed to file a further appeal with the Tax Court of New Jersey. If your property is assessed for more than $750,000, you may file directly with the Tax Court by April 1st annually.

In Summary

A taxpayer filing an appeal should consider the following questions.

- What was the market value of my property of the pretax year?

- Can I support my conclusion of market value with credible evidence?

- Is my property assessed in excess of its market value if a reassessment/revaluation was implemented in the current tax year? If a revaluation/reassessment was not implemented, does my assessment exceed market value or does the ratio of my property assessment to its market value exceed the upper limit of the common level range?

For additional information, or to request tax forms, call the Bergen County Board of Taxation at 201-336-6300 or write:

Bergen County Board of Taxation

Administration Building

One Bergen

County Plaza, Room 370

Hackensack, NJ 07601-7000

Visit the Bergen County Board of Taxation's web site at www.co.bergen.nj.us/taxboard.

Property Tax Forms

Where in Elmwood Park is it?

182 Market Street, Elmwood Park, NJ

Borough Administrator: Michael Foligno

Borough Administrator: Michael Foligno

Tax Collector: Lori Sproviero

Tax Collector: Lori Sproviero Tax Assessor: Kevin Esposito

Tax Assessor: Kevin Esposito Fire Official: Steven Kochik

Fire Official: Steven Kochik Director: Christine Cobb

Director: Christine Cobb Chief: Gregory Thompson

Chief: Gregory Thompson  Director: Chief Michael Foligno

Director: Chief Michael Foligno Borough Clerk

Borough Clerk Borough Clerk: Shanee Morris, RMC, CMR

Borough Clerk: Shanee Morris, RMC, CMR

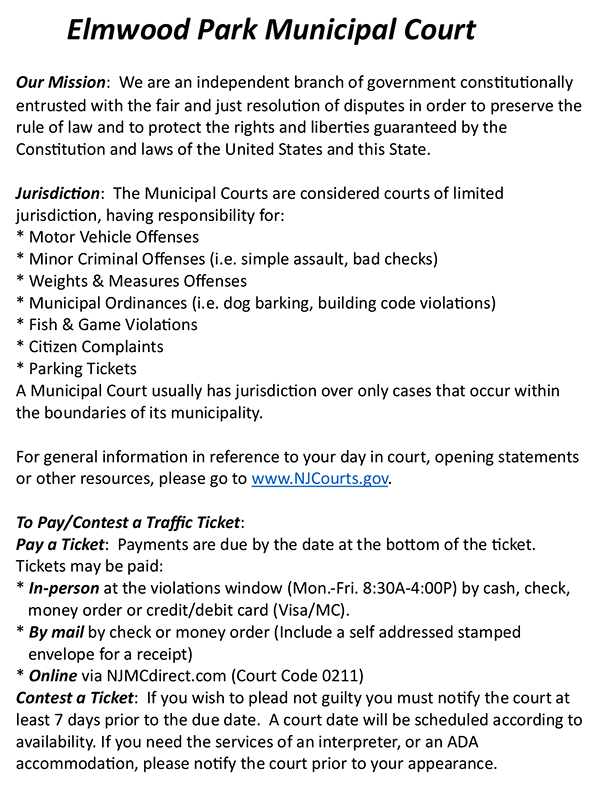

Borough of Elmwood Park Building Department

Borough of Elmwood Park Building Department Recreation Director: Dale Fava

Recreation Director: Dale Fava Dear Elmwood Park Community,

Dear Elmwood Park Community,

Chief of Police: Michael Foligno

Chief of Police: Michael Foligno

IMPORTANT NOTICE REGARDING VOTER REGISTRATION: If you are not registered, have changed your name, or moved from one district to another, please call the Municipal Clerk's Office. Registration books are closed 21 days before each election; therefore, to vote you must register before that time.

IMPORTANT NOTICE REGARDING VOTER REGISTRATION: If you are not registered, have changed your name, or moved from one district to another, please call the Municipal Clerk's Office. Registration books are closed 21 days before each election; therefore, to vote you must register before that time. Department Head

Department Head

Free Blood Pressure Clinic and Health Consultation

Free Blood Pressure Clinic and Health Consultation A request for access to or for a copy of Government Records should be submitted on the form which has been adopted by the Municipal Clerk as the Custodian of Records. Some records will be immediately available during normal business hours. Some records will require time to compile and to make the copies requested, but will normally be available during normal business hours and within seven (7) business days. If any document or copy which has been requested is not a public record or cannot be provided within the seven (7) business days, you will be provided with a response with that information within the seven (7) business days. Some records requested have specific fees or other response times established by statute. There is no fee involved in simply inspecting a document during normal business hours. This request may be filed electronically.

A request for access to or for a copy of Government Records should be submitted on the form which has been adopted by the Municipal Clerk as the Custodian of Records. Some records will be immediately available during normal business hours. Some records will require time to compile and to make the copies requested, but will normally be available during normal business hours and within seven (7) business days. If any document or copy which has been requested is not a public record or cannot be provided within the seven (7) business days, you will be provided with a response with that information within the seven (7) business days. Some records requested have specific fees or other response times established by statute. There is no fee involved in simply inspecting a document during normal business hours. This request may be filed electronically. There are downloadable brochures and/or documents available online regarding marriage licenses - please visit

There are downloadable brochures and/or documents available online regarding marriage licenses - please visit  There are a number of downloadable brochures and documents available on this site regarding pandemic flu: please visit the Health Department Forms page.

There are a number of downloadable brochures and documents available on this site regarding pandemic flu: please visit the Health Department Forms page.